- #Quickbooks for accountants online how to

- #Quickbooks for accountants online software

- #Quickbooks for accountants online free

Specifically, QuickBooks calculates the class allocations for the report each time you run the report. Important: The Balance Sheet by Class report is an advanced report that differs from other QuickBooks reports. Here is information taken directly from the Intuit Support Site: However, the Balance Sheet by Class report is only available in QuickBooks Premier and Enterprise Solutions. Intuit recommends using Classes in QuickBooks for Nonprofits to generate a Balance Sheet by fund, but there are inherent flaws in the design of QuickBooks that limit its capabilities in this area. Get in-depth training on fund accounting, budgets, financials and more. Nonprofit Accounting Course: Learn essential skills to strengthen accountability and avoid costly mistakes.

#Quickbooks for accountants online free

Organizations are free to use any method of record keeping they wish, as long as the final result – the financial statements seen by the public – are in the proper form. Accounting standards issued by the accounting profession deal only with external financial reporting, not how the internal books are kept. This distinction between internal accounting and external financial reporting is important to understand. In addition the fund accounting financial records will be the basis for preparation of the financial statements used for reporting to the public. The concept of fund accounting will continue to be appropriate for many organizations for keeping their books and for internal reporting to management, funding sources and the board.

#Quickbooks for accountants online software

While this concept of separate funds in itself is not particularly difficult, it does create problems when trying to apply these principals with accounting software that is not designed to separate activity by funds.

#Quickbooks for accountants online how to

Typically in reporting, an organization using fund accounting will present separate financial statements for each fund.įree eBook Download: How to Generate Compliant Nonprofit Reportsįund accounting is widely used by not-for-profit organizations because it provides the ability in ensure compliance with legal restrictions and to report on the organization’s stewardship of amounts entrusted by funding sources. All unrestricted revenue are in one fund, all temporarily restricted revenue in another, all permanently restricted in a third, and so forth.

In fund accounting, amounts are segregated into categories according to restrictions placed by funding sources and designations placed by the organization’s governing board on their use. All software packages designed to be used in for-profit businesses do not have fund accounting capabilities. The separation of accounting records by departments, branches and product lines is sometimes done in for-profit business accounting, but this is not the same as the separation that nonprofits need for fund accounting. As a consequence, fund accounting more than any other single concept of not-for-profit accounting, is the reason why not-for-profit organizations need proper fund accounting software tools for proper accountability and stewardship of funds. What is Fund Accounting?įund Accounting is unique to not-for-profit organizations. Trying to shoe-horn the functionality of an off-the-self commercial accounting package, such as QuickBooks for Nonprofits or Peachtree, into the requirements for a nonprofit organization could be risky and jeopardize the fiscal well-being of your organization. Most importantly, it must demonstrate accountability to funding sources. Unlike for-profit businesses, it must have management objectives and generate unique reports both for internal and external use. That way I do not waste time on people who do not know how to do it.Not-for-Profit Organizations must follow nonprofit accounting guidelines. If you do, say "I already know how to do this and can help now". I need to know that you know how to do this.

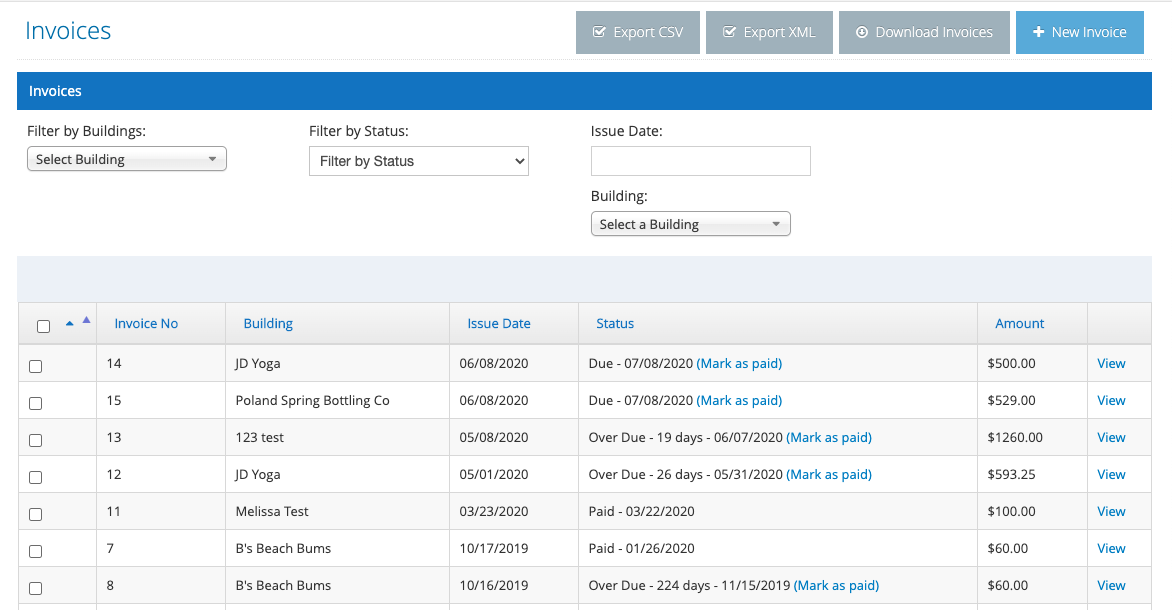

I will pay for your knowledge even if you do not have to do any of the work for us. Is it possible to send time to QBO as either Regular Time, Overtime, or some other Payroll item? We can do this with QB Desktop very easily. If an employee works more than xx hours, we need the abiliyt to send that information to QB and flag it as a certain payroll item. One of the features in our system is time tracking. Our system is fully integrated with QB Online and QB Desktop.

0 kommentar(er)

0 kommentar(er)